All Categories

Featured

Table of Contents

That generally makes them an extra economical choice for life insurance coverage. Some term plans may not keep the costs and survivor benefit the exact same with time. Term life insurance with accidental death benefit. You don't wish to erroneously think you're getting level term coverage and then have your survivor benefit adjustment in the future. Several individuals get life insurance policy coverage to assist financially shield their enjoyed ones in instance of their unanticipated fatality.

Or you may have the option to transform your existing term protection right into a permanent plan that lasts the rest of your life. Different life insurance plans have potential advantages and disadvantages, so it is very important to recognize each before you make a decision to buy a policy. There are numerous advantages of term life insurance policy, making it a prominent choice for insurance coverage.

As long as you pay the premium, your recipients will certainly get the fatality advantage if you die while covered. That stated, it's crucial to keep in mind that most policies are contestable for 2 years which indicates protection might be retracted on fatality, needs to a misrepresentation be found in the app. Plans that are not contestable often have actually a graded death benefit.

The Meaning of Term Life Insurance For Spouse

Costs are generally less than entire life policies. With a degree term policy, you can pick your coverage quantity and the policy size. You're not locked right into an agreement for the remainder of your life. Throughout your plan, you never have to fret about the costs or fatality advantage amounts transforming.

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)

And you can't pay out your plan throughout its term, so you will not receive any kind of economic advantage from your previous insurance coverage. As with various other types of life insurance, the cost of a degree term plan depends on your age, insurance coverage needs, employment, way of living and health. Typically, you'll find more cost effective coverage if you're younger, healthier and much less dangerous to guarantee.

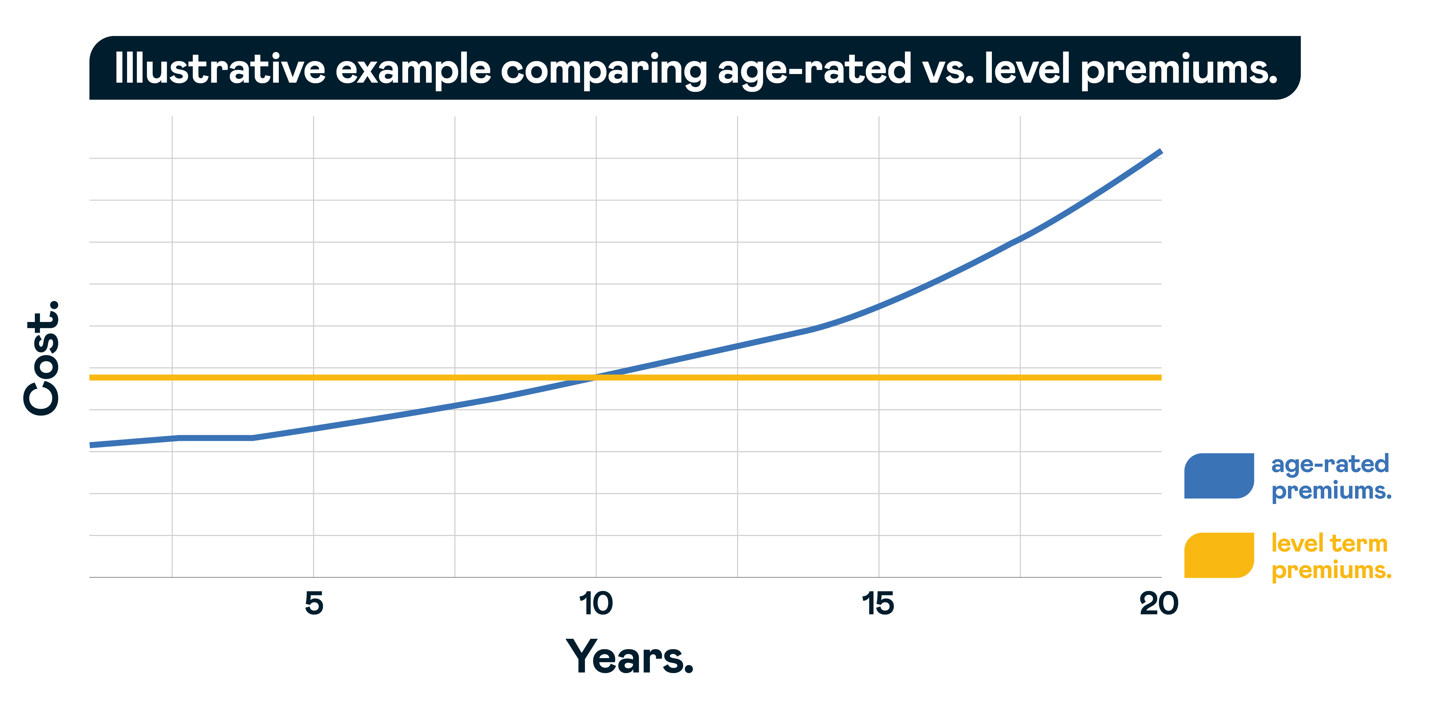

Given that degree term premiums remain the same throughout of insurance coverage, you'll recognize specifically how much you'll pay each time. That can be a big assistance when budgeting your costs. Degree term insurance coverage also has some adaptability, allowing you to customize your plan with added attributes. These often been available in the form of cyclists.

What is the Coverage of Term Life Insurance For Spouse?

You might have to meet particular problems and certifications for your insurance firm to pass this biker. On top of that, there might be a waiting duration of up to six months prior to working. There likewise might be an age or time restriction on the coverage. You can include a youngster rider to your life insurance policy plan so it likewise covers your youngsters.

The survivor benefit is usually smaller, and insurance coverage usually lasts until your youngster transforms 18 or 25. This motorcyclist may be a more cost-efficient method to help ensure your youngsters are covered as cyclists can usually cover numerous dependents at as soon as. As soon as your youngster ages out of this protection, it may be possible to convert the cyclist into a brand-new plan.

The most usual kind of irreversible life insurance policy is entire life insurance, but it has some essential distinctions contrasted to level term coverage. Right here's a fundamental introduction of what to think about when comparing term vs.

Why You Should Consider Term Life Insurance With Level Premiums

Whole life entire lasts insurance policy life, while term coverage lasts protection a specific periodDetails The premiums for term life insurance policy are typically reduced than whole life insurance coverage.

One of the main functions of level term protection is that your costs and your death benefit don't alter. You may have insurance coverage that starts with a fatality advantage of $10,000, which can cover a mortgage, and after that each year, the death benefit will certainly reduce by a collection quantity or percentage.

As a result of this, it's usually an extra economical kind of degree term insurance coverage. You might have life insurance policy with your employer, but it might not suffice life insurance coverage for your needs. The initial step when purchasing a policy is determining how much life insurance coverage you need. Think about elements such as: Age Family members dimension and ages Employment status Earnings Financial debt Lifestyle Expected final costs A life insurance policy calculator can assist figure out how much you require to begin.

What is Term Life Insurance With Level Premiums? Pros, Cons, and Features

After making a decision on a plan, finish the application. If you're approved, sign the documentation and pay your initial costs.

You may want to update your beneficiary details if you have actually had any type of considerable life adjustments, such as a marital relationship, birth or separation. Life insurance coverage can occasionally feel difficult.

No, level term life insurance policy doesn't have money worth. Some life insurance policy plans have an investment attribute that permits you to develop cash money worth with time. A portion of your premium payments is reserved and can make interest with time, which grows tax-deferred during the life of your protection.

Nevertheless, these plans are often substantially a lot more expensive than term insurance coverage. If you get to completion of your policy and are still alive, the protection finishes. You have some options if you still want some life insurance policy coverage. You can: If you're 65 and your insurance coverage has gone out, as an example, you might intend to buy a new 10-year degree term life insurance plan.

What is Term Life Insurance and Why Is It Important?

You may have the ability to transform your term coverage right into an entire life plan that will certainly last for the remainder of your life. Numerous sorts of level term policies are convertible. That means, at the end of your coverage, you can transform some or every one of your policy to entire life protection.

A level premium term life insurance coverage plan lets you stick to your budget while you aid safeguard your household. ___ Aon Insurance Coverage Solutions is the brand name for the broker agent and program administration operations of Affinity Insurance Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Coverage Company, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Coverage Services Inc.; in CA, Aon Affinity Insurance Policy Solutions, Inc .

Latest Posts

Best Funeral Insurance Companies

Final Expense Insurance Rates

Funeral And Life Insurance